Understanding and Managing NAERSA in HRBlizz

With the launch of Ireland’s Auto-Enrolment (AE) scheme, MyFutureFund, a new statutory body has become central to the Irish payroll landscape: the National Automatic Enrolment Retirement Savings Authority (NAERSA).

What is NAERSA?

NAERSA is an independent government body responsible for administering the MyFutureFund scheme. Unlike traditional pension models where employers select providers and manage eligibility, NAERSA acts as the central administrator and caretaker. They determine employee eligibility, manage the investment of funds, and facilitate the unique State “top-up” contribution.

For employers, NAERSA represents a fundamental shift in responsibility. The authority now drives the enrollment process using real-time payroll data, effectively removing the burden of manual eligibility assessments from the employer.

Managing NAERSA in HRBlizz

The HRBlizz platform features an embedded integration with NAERSA, functioning as a bi-directional data exchange similar to the existing Revenue PAYE Modernisation (PMOD) framework.

1. Configuration and Setup

To begin, clients must ensure their ROS (Revenue Online Service) Digital Certificate is uploaded and active within HRBlizz. This certificate is the secure key that allows the platform to communicate with NAERSA.

Clients must also define their Pensionable Pay by reviewing their wage type catalogue. A formal Change Request (CR) is required to flag specific earning elements—such as basic pay, overtime, and bonuses—as included in Auto-Enrolment calculations.

2. The Pre-Payroll Routine: AEPN Retrieval

Before every payroll run, HRBlizz retrieves an Automatic Enrolment Payroll Notification (AEPN). Just as the system fetches tax credits via RPNs, the AEPN provides explicit instructions from NAERSA on:

- Which employees to enroll.

- Which employees are exempt (e.g., those already in a private pension).

- The specific contribution rates to apply.

The system uses the latest AEPN to ensure compliance. If a new AEPN is issued but not used, NAERSA may return an error and reject the payroll calculation.

3. Processing Payroll

Once the AEPN data is pulled, HRBlizz automatically calculates the contributions. At launch, the standard rates are 1.5% for the employee and 1.5% for the employer. These deductions are calculated on “Gross Pay” as defined by statute, up to a Year-To-Date earnings cap of €80,000. Once an employee hits this limit, the system will automatically stop deductions for the remainder of the tax year.

4. Post-Payroll: Submission and Status Tracking

After finalizing the payroll run, HRBlizz transmits a Contribution Submission file to NAERSA. Users can monitor the status of these submissions in the Compliance section of the platform.

- Success: Contributions are accepted.

- Partial Success/Errors: The system will display error descriptions for specific records. NAERSA often accepts valid records while rejecting errored ones, allowing for targeted corrections without re-running the entire payroll.

Note that alterations or deletions to submissions are only permitted until 18:30 IST on the pay date.

Benefits to the Client (Employer)

- Risk Mitigation and Compliance: By following NAERSA’s direct AEPN instructions, the “decision” of who to enroll is removed from the employer’s hands, ensuring 100% statutory compliance and eliminating the risk of wrongful exclusion or deduction.

- Administrative Efficiency: HRBlizz handles the “heavy lifting” by tracking rolling eligibility periods and age thresholds (e.g., employees turning 23). This “set and forget” functionality allows HR teams to focus on strategy rather than administrative tracking.

- Cost Certainty: Accurate calculations based on integrated statutory definitions prevent under-payment liabilities and over-payment errors. Employer contributions are also a fully deductible expense for Corporation Tax purposes and are not treated as a taxable Benefit-in-Kind (BIK) for employees.

Benefits to the Employee

- The “Pot-Follows-Member” Model: Because NAERSA centralizes administration, an employee’s pension pot stays with them as they move between jobs. The HRBlizz integration ensures their unique identifier links contributions to the same pot instantly upon joining a new company.

- State Top-Up: For every €3 an employee contributes, the State provides a €1 top-up. This lucrative benefit is reported in real-time, providing immediate financial growth for the employee’s retirement savings.

- Transparency and Control: Employees manage their own opt-outs and suspensions directly through the NAERSA portal. These instructions flow back to HRBlizz automatically, ensuring the employer respects the employee’s choice without requiring a manual, paper-based request process.

- Financial Wellness: Auto-enrolment ensures that even employees without private pension knowledge are building a portable, state-supported retirement fund from their first eligible day of work.

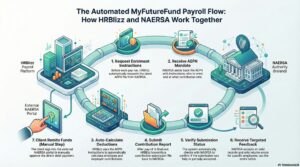

Below flowchart of interaction between HRBlizz and NAERSA

Payroll business process in detail: MyFutureFund_Business_Processes_Document_V1.3

We’re glad. Tell us how this page helped.

We’re sorry. Can you tell us what didn’t work for you?

Newsletter

Simplifying employment tasks worldwide.

Let us help you make sure you’re on the right track. Join 15,000+ subscribers and receive exclusive tips and resources.